Overwhelmed by uncertainty about your finances? 🗝 The labyrinth of loans is a lifesaver most of the time. There are all sorts of loans, mortgages, personal, and otherwise; it all feels endless, and all is really gibberish to your head! But fear not! You dont have to have your head exploded by the experience of understanding loans.

Think what if you could have a good decision on your financial future. – The loan works as a magic wand in the right hands whether it be purchasing a home, starting a new business, or wrapping up a previous debt. So how do you choose the greatest one? What makes you eligible for the drawing? So, most importantly, how do you make sure you do not miss into debt?

In this complete guide, we will delve into the universe of loans, from sorts to advancements to repayment propensities. In this guide, we will cover everything from interest rates to secrets for improving your chances of approval and how to protect yourself from predatory lenders. Are you ready to take charge of your own financial destiny and pave the way to your dreams? 🚀

Types of Loans

Loans come in various forms, catering to different financial needs:

- Personal Loans: Unsecured, flexible-use loans

- Mortgage Loans: For home purchases

- Auto Loans: Vehicle financing

- Student Loans: Education funding

- Business Loans: For entrepreneurial ventures

| Loan Type | Purpose | Typical Interest Rates |

|---|---|---|

| Personal | Various | 6% – 36% |

| Mortgage | Home | 3% – 6% |

| Auto | Vehicle | 4% – 10% |

| Student | Education | 3% – 13% |

| Business | Enterprise | 6% – 60% |

Understanding Interest Rates

Interest rates play a crucial role in loans. Fixed rates offer stability, while variable rates fluctuate. The Annual Percentage Rate (APR) provides a comprehensive view of loan costs. Here’s a comparison:

| Rate Type | Pros | Cons |

|---|---|---|

| Fixed | Predictable payments | Higher initial rate |

| Variable | Lower initial rate | Potential for increased payments |

Interest rates significantly impact overall loan costs, affecting monthly payments and total repayment amount.

Factors Affecting Loan Approval

Lenders consider several key factors when evaluating loan applications:

- Credit Score

- Income and Employment

- Debt-to-Income Ratio

- Collateral Requirements

| Factor | Importance |

|---|---|

| Credit Score | High |

| Income | High |

| DTI Ratio | Medium |

| Collateral | Varies |

Understanding these factors can significantly improve your chances of loan approval.

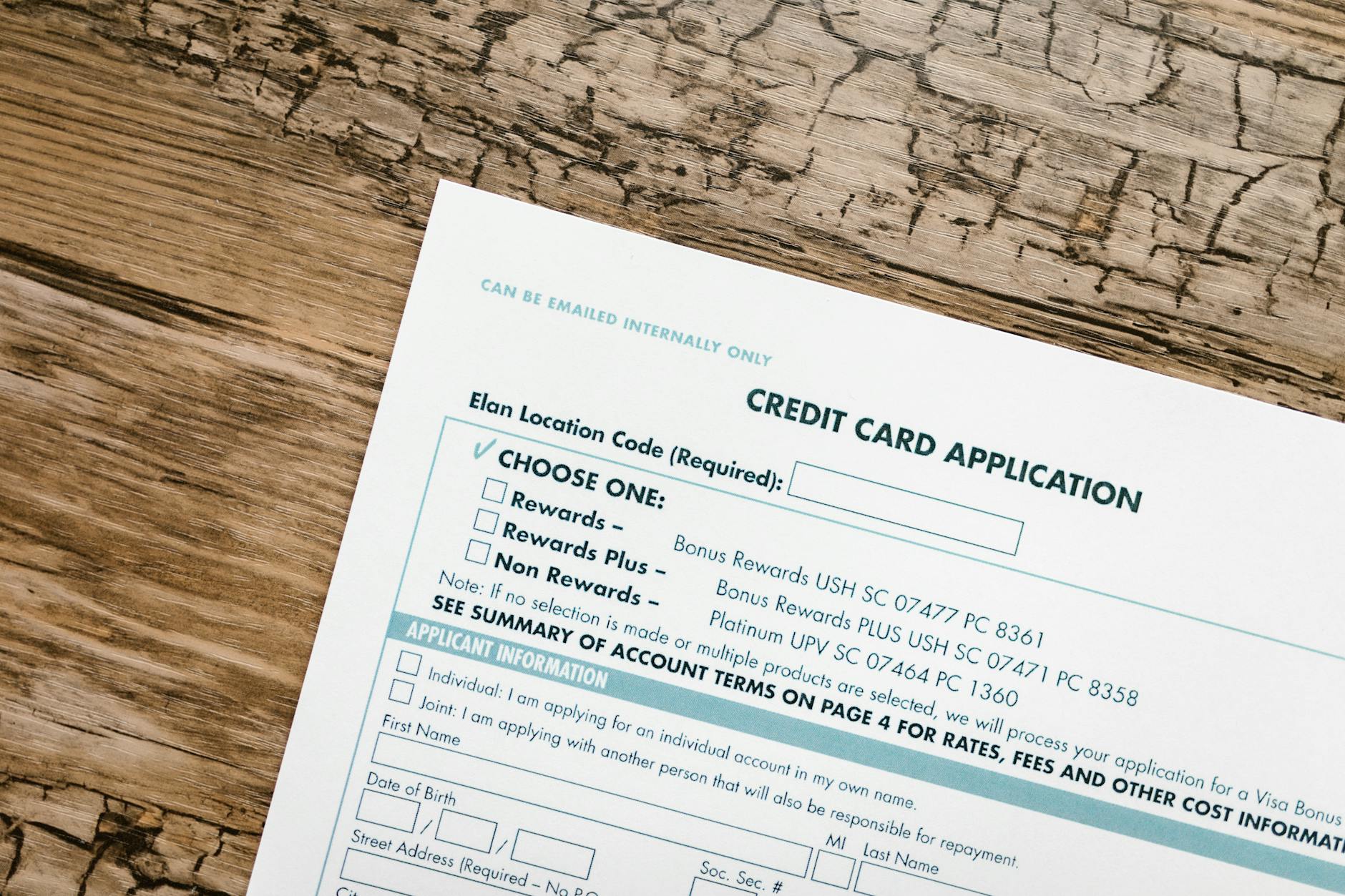

Loan Application Process

Gathering Necessary Documents

Before applying for a loan, gather essential documents:

- Proof of income (pay stubs, tax returns)

- Bank statements

- Identification (driver’s license, passport)

- Proof of address (utility bills)

Pre-qualification vs. Pre-approval

| Pre-qualification | Pre-approval |

|---|---|

| Informal estimate | In-depth review |

| No credit check | Credit check |

| Quick process | Longer process |

Repayment Strategies

Effective loan repayment requires a solid understanding of terms, early repayment benefits, and refinancing options. Consider these strategies:

- Early repayment: Reduces interest

- Refinancing: Lowers rates or extends terms

- Hardship programs: Temporary relief

| Strategy | Benefit |

|---|---|

| Early repayment | Saves on interest |

| Refinancing | Better terms |

| Hardship programs | Temporary relief |

Avoiding Predatory Lending

Protect yourself from predatory lending by recognizing red flags:

- Excessive fees

- Pressure to borrow more

- Unclear terms

Understand your rights as a borrower and explore alternatives to high-interest loans:

| Alternative | Benefit |

|---|---|

| Credit unions | Lower rates |

| Peer-to-peer lending | Flexible terms |

| Government programs | Specific assistance |

Improving Your Chances of Loan Approval

To increase your loan approval odds, focus on:

- Boosting credit score

- Reducing debt

- Saving for down payment

- Seeking a co-signer

| Action | Impact |

|---|---|

| Credit improvement | Higher approval chance |

| Debt reduction | Better debt-to-income ratio |

| Down payment | Lower risk for lender |

| Co-signer | Added financial security |

The world of loans can be difficult to navigate, but knowing how to do it right can help you achieve your credit milestones. Everything counts, starting from knowing how various loan types work and interest rates, all the way to the application process and repayment strategies. Take this as a caution not to engage in predatory lending and remember to build on your creditworthiness to increase the likelihood of getting approved for loans.

In conclusion, loans can be an effective financial instrument if you are going to take them wisely. Suscribing to the ins and outs of borrowing prepares you towards selecting the ideal mortgage, repaying it properly, and developing a great amount of financial problems. Spend some time on proper research and comparison before choosing an option, and consult the experts where necessary. It all adds up if it means that you will be better off financially.