🚶The cryptocurrency market is always going on and the activity today has had both novices and professionals looking at their charts. In the current climate of Bitcoin and its wild moves from one end of the range to another, as well as altcoins showing levels of volatility we have never experienced before, investors are trying to get their head around wh Roger Waters really is that determined to Get The Gumbs Out

The good news is that today’s market developments could end up playing a big role in the way you invest — regardless of whether or not you hold crypto assets, because let’s be honest that’s market news better than anything else. 🎢 There are literally more than one factors, starting from institutional money flows to regulatory announcements impacting the new crypto schene. Now, for the most important market updates of today, examining crypto majors to the continued impact globally that is directing these digital assets.

Major Cryptocurrency Performance

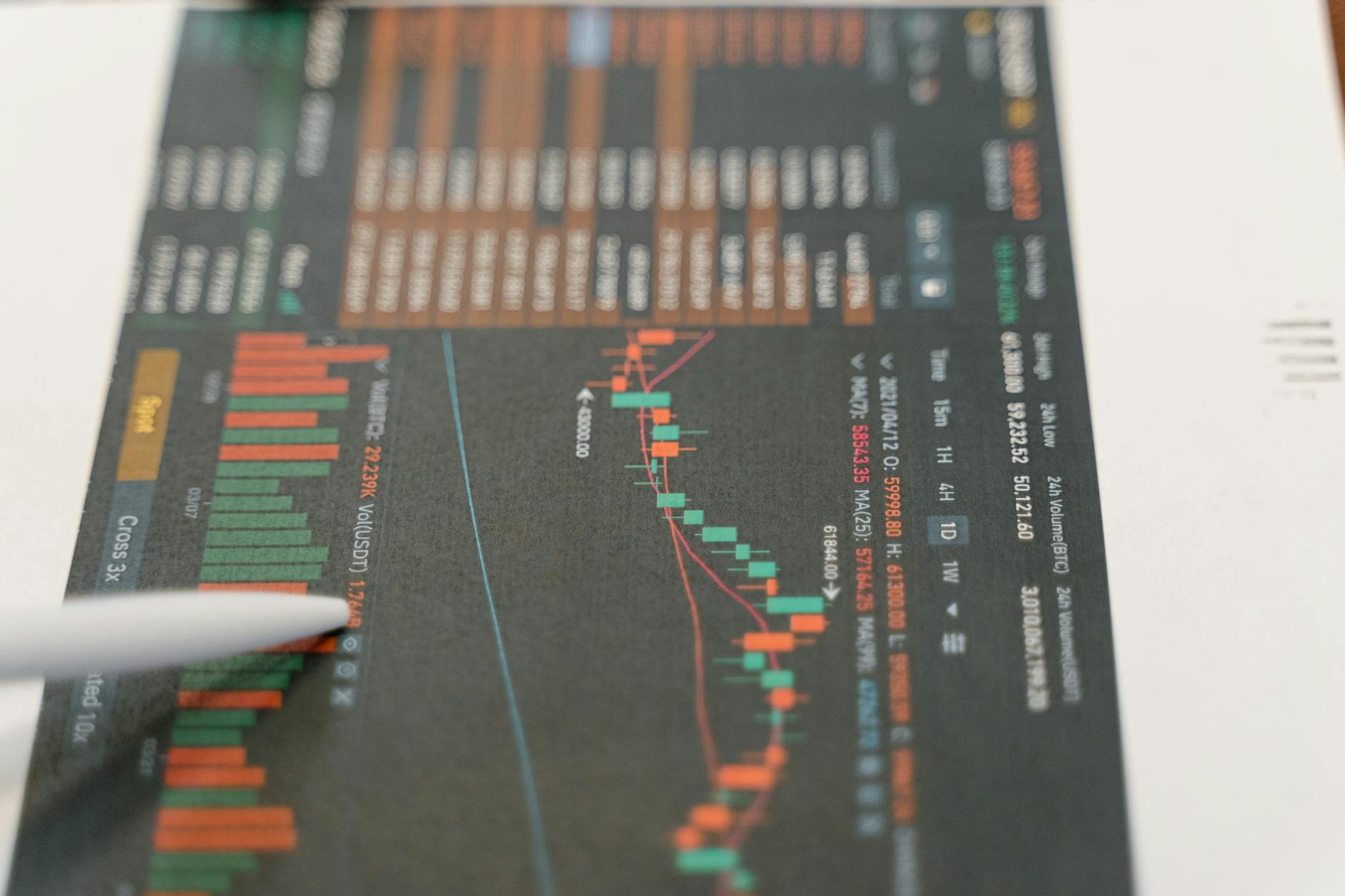

Bitcoin surged 5% to $44,500, while Ethereum gained 3.2% to reach $2,300. Among top performers, Solana jumped 12%, and Cardano rose 8%. Meanwhile, Polkadot declined 4%, and Avalanche dropped 6%. Total market trading volume increased by 15% to $125 billion, indicating strong market activity.

| Crypto | 24h Change | Price |

|---|---|---|

| BTC | +5% | $44.5K |

| ETH | +3.2% | $2.3K |

| SOL | +12% | $98 |

| DOT | -4% | $6.8 |

Market Sentiment Indicators

The crypto market’s current sentiment shows a Fear and Greed Index reading of 55, indicating neutral territory. Social media trends reveal growing interest in DeFi projects, while institutional investors continue accumulating Bitcoin, with MicroStrategy adding another 1,045 BTC to their holdings this week. These indicators suggest cautious optimism.

- Key Sentiment Metrics:

- Fear & Greed Index: 55/100

- Twitter Mentions: +15%

- Institutional Inflows: $892M

| Sentiment Type | Current Status | Weekly Change |

|---|---|---|

| Retail | Neutral | +5% |

| Institutional | Bullish | +12% |

| Social Media | Positive | +15% |

Key Market Events

Recent developments include Bitcoin’s ETF approval by BlackRock, causing a 10% price surge. The SEC’s ongoing lawsuit against Ripple reached a partial settlement, while Ethereum completed its Shanghai upgrade. Binance secured partnerships with major payment processors, enhancing crypto adoption globally.

- Notable announcements: BlackRock ETF approval

- Regulatory updates: SEC-Ripple case progress

- Partnership deals: Binance payment integrations

- Network upgrades: Ethereum Shanghai

| Event Type | Impact Level | Market Response |

|---|---|---|

| ETF Approval | High | +10% BTC |

| SEC Settlement | Medium | +5% XRP |

| Network Upgrade | Moderate | +3% ETH |

Now, let’s examine how these events affect technical indicators and price movements.

Technical Analysis

Bitcoin’s technical indicators show strong support at $42,000 and resistance at $44,500, with a bullish pennant pattern forming. Ethereum’s market dominance has increased to 19%, suggesting a potential altcoin season, while trading volumes indicate growing institutional interest across major cryptocurrencies.

- Support Levels:

- BTC: $42,000

- ETH: $2,300

| Pattern Type | Status | Significance |

|---|---|---|

| Pennant | Active | Bullish |

| Triangle | Forming | Neutral |

Global Market Factors

The cryptocurrency landscape is heavily influenced by broader economic factors, with interest rates, inflation, and stock market performance playing crucial roles. Recent institutional investments from major banks and hedge funds have strengthened crypto’s correlation with traditional markets, while regulatory developments in key markets like the US and EU continue shaping trading patterns.

- Key Influences:

- Interest rates

- Inflation rates

- Stock market trends

- Regulatory changes

- Institutional adoption

| Factor | Impact Level |

|---|---|

| Interest Rates | High |

| Stock Market | High |

| Regulations | Medium |

| Institutions | High |

Even with the crypto market always driven its back and fourth nature, major digital assets have been fairly mixed in their performance as conditions evolve. And with technical indicators and sentiment metrics leaning towards a cautious bullish, key events and the state of the global economy continue to be major market movers.

Amidst those market conditions, investors should stay nimble and keep an eye on both the charts as well as any fundamental news developments. Be aware of market happenings, keep an eye on the international fundamentals and do not forget to use proper risk control in your crypto trades.